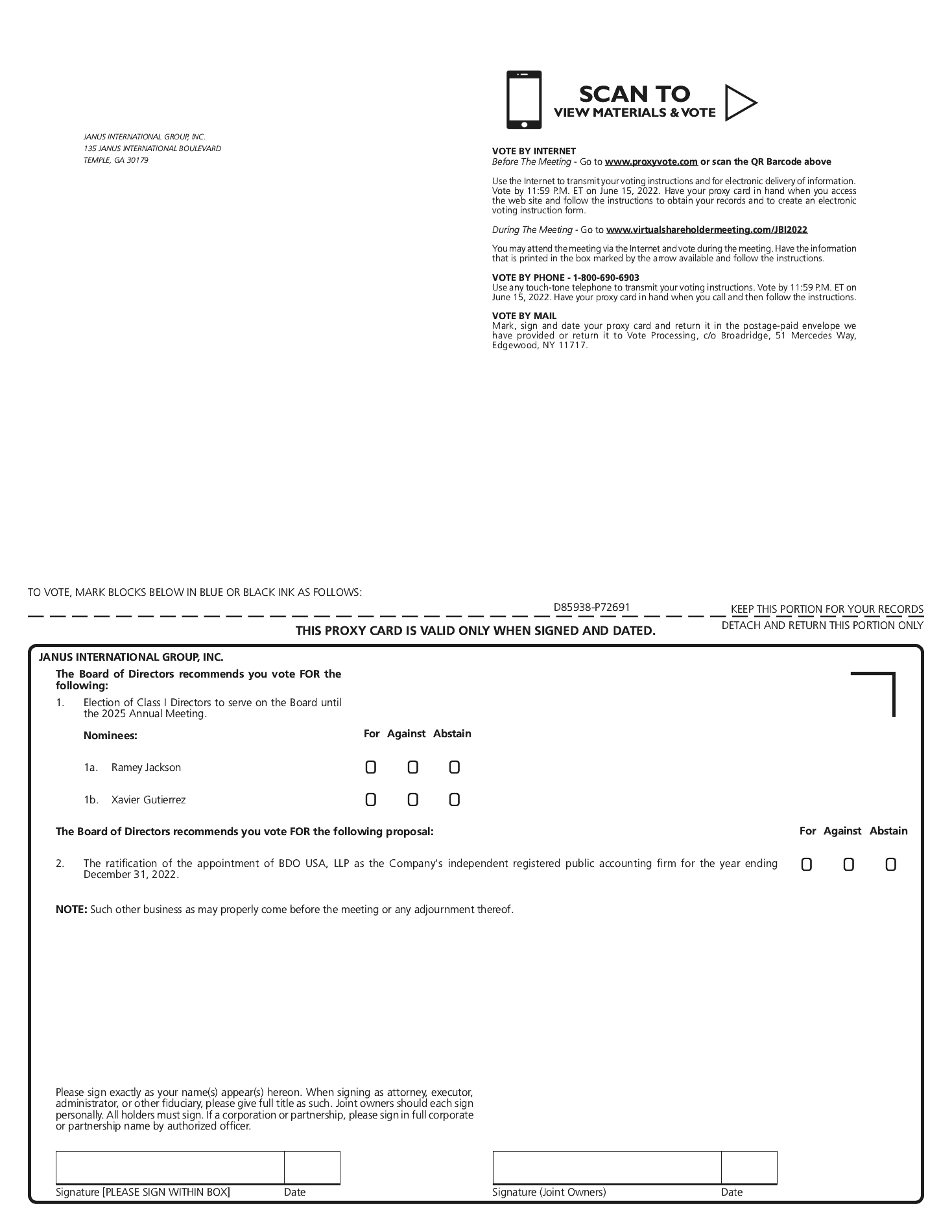

Sponsor Directors, the two initial independent directors, and the Chief Executive Officer of the Company comprised the initial Board of Directors appointed in connection with the Business Combination. The Board shall be divided in three classes designated as Class I, Class II, and Class III, with each director serving a three-year term and one class being elected at each year’s annual meeting of stockholders of the Company. One initial independent director, one Clearlake Director, and the Chief Executive Officer were nominated as Class I directors with initial terms ending at the Company’s 2022 annual meeting of stockholders; one initial independent director, one Clearlake Director, and one Sponsor Director were nominated as Class II directors with initial terms ending at the Company’s 2023 annual meeting of stockholders; and two Clearlake Directors and one Sponsor Director were nominated as Class III directors with initial terms ending at the Company’s 2024 annual meeting of stockholders.

The Nominating and Corporate Governance Committee is considering candidates to an existing vacancy in Class I and may make recommendations to the Board to appoint a director to fill the vacancy.

PIPE Subscription Agreements

Concurrently with the execution and delivery of the Business Combination Agreement, certain institutional accredited investors (the “PIPE Investors”) entered into subscription agreements (the “PIPE Subscription Agreements”) pursuant to which the PIPE Investors purchased an aggregate of 25,000,000 shares of Common Stock (the “PIPE Shares”) at a purchase price per share of $10.00 (the “PIPE Investment”). Certain of the Company’s directors purchased an aggregate of 1,000,000 of the PIPE Shares as part of the PIPE Investment.

The PIPE Investment closed on June 7, 2021 and the issuance of an aggregate of 25,000,000 shares of Common Stock occurred concurrently with the consummation of the Business Combination. The sale and issuance was made to accredited investors in reliance on Rule 506 of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”).

Janus’s Related Party Transactions

Prior to the Business Combination, Jupiter Intermediate Holdco, LLC, on behalf of Janus, entered into a Management and Monitoring Services Agreement (MMSA) with the Class A Preferred Unit holders group. Janus paid management fees to the Class A Preferred Unit holders group for the years ended January 1, 2022 and December 26, 2020 of approximately $1,124,000 and $7,101,000, respectively. Approximately $896,000 of the Class A Preferred Unit holders group management fees were accrued and unpaid as of December 26, 2020 and no fees were accrued and unpaid as of January 1, 2022. As a result of the Business Combination the MMSA was terminated effective June 7, 2021.

Janus’s subsidiary, Janus International Group, LLC leases a manufacturing facility in Butler, Indiana, from Janus Butler, LLC, an entity wholly owned by a former member of the Board of Directors of the Company. Effective October 20, 2021 the member resigned from the Board of the Company. Rent payments paid to Janus Butler, LLC for the years ended January 1, 2022 and December 26, 2020 were approximately $135,000 and $134,000, respectively. The original lease extends through October 31, 2021 and on November 1, 2021 the lease was extended to October 31, 2026, with monthly payments of approximately $13,000 with an annual escalation of 1.5%.

Janus’s subsidiary, Janus International Group, LLC was previously a party to a lease agreement with 134 Janus International, LLC, which is an entity majority owned by a former member of the Board of Directors of the Company. In December 2021, the leased premises in Temple, Georgia were sold by the former director to a third-party buyer, resulting in an assignment of the lease to said third-party buyer and an extension of the lease to November 30, 2031. Rent payments paid to 134 Janus International, LLC in the years ended January 1, 2022 and December 26, 2020 were approximately $343,000 and $446,000, respectively.

Janus’s subsidiary, ASTA Industries, Inc. is a party to a lease agreement with ASTA Investment, LLC, for a manufacturing facility in Cartersville, Georgia, which is an entity partially owned by a shareholder of the Company. The original lease term began on April 1, 2018 and extended through March 31, 2028 and was amended in December 2020 to extend the term until March 1, 2030, with monthly lease payments of approximately $66,000 per month with an annual escalation of 2.0%. Rent payments to ASTA Investment, LLC for the years ended January 1, 2022 and December 26, 2020 were approximately $801,000 and $837,000, respectively.