Elements of Our Executive Compensation Program

The compensation of our named executive officers consists of a base salary, annual cash bonus opportunities, long-term equity incentive awards, and other benefits, as described below.

Base Salary

Annual base salaries provide our named executive officers with a predictable level of cash compensation, and stability with respect to a portion of their total compensation. We believe that our named executive officers’ base salaries should reflect factors such as the executive’s performance, experience, and breadth of overall responsibilities. The base salaries of our named executive officers are intended to be generally competitive within our peer group. As of December 30, 2023, the annual base salaries of Messrs. Jackson, Wong, Hodges, Nettie, and Frayser were $895,000, $500,000, $435,200, $404,700, and $379,200, respectively. Consistent with the Company’s compensation philosophy and based on Mercer’s executive compensation study as compared to our peer group, the adjustments in base salary and bonus bring our executive pay in line with market pay for similarly situated roles.

Annual Cash Incentives

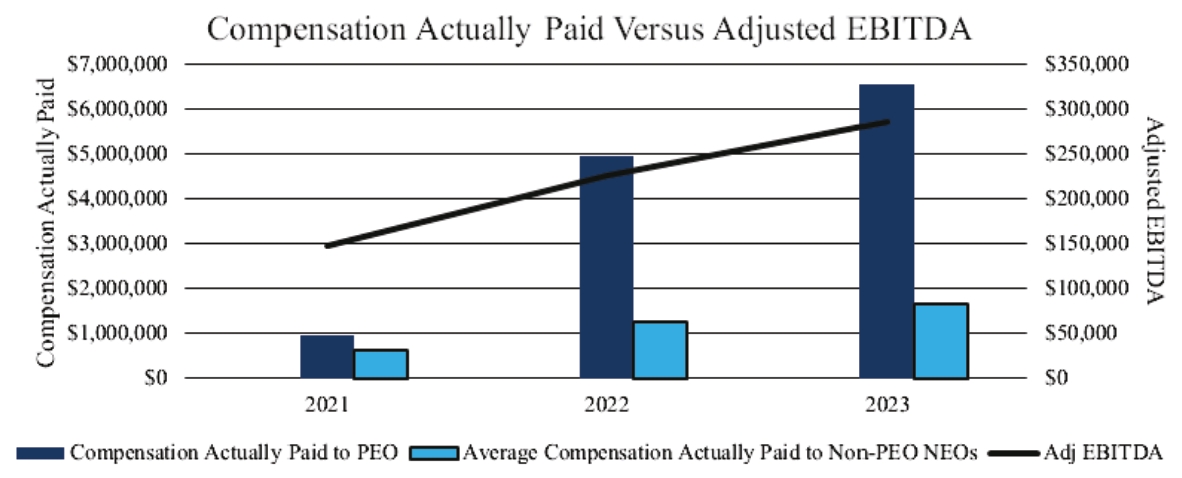

For our fiscal year ended December 30, 2023, the compensation program for our named executive officers included an annual cash incentive bonus opportunity under the Janus Management Incentive Plan (“Management Incentive Plan”). We believe that an annual cash incentive bonus program is an important way to incentivize our executives to focus on the achievement of the Company’s financial performance. Annual cash bonus opportunities under the Management Incentive Plan for 2023 were based on our achievement of an Adjusted EBITDA target as shown in the table below. We define Adjusted EBITDA as net income excluding interest expense, income taxes, depreciation expense, amortization, and other non-operational, non-recurring items.

Adjusted EBITDA (millions) | | | 100% | | | $275.0 | | | $285.6 | | | 103.9% | | | 192% |

Based on the Adjusted EBITDA performance described above, for the fiscal year ended on December 30, 2023, Messrs. Jackson, Wong, Hodges, Nettie, and Frayser received cash bonuses under the Management Incentive Plan in the amount of $1,706,400, $720,000, $590,568, $535,968, and $318,528, respectively, following the completion of our audited financials. Mr. Frayser’s Management Incentive Plan bonus was pro-rated for the portion of the fiscal year after May 1, 2023.

For the portion of fiscal 2023 ending on May 1, 2023, Mr. Frayser also participated in an informal commission-based compensation plan, which provided him a commission-based cash payment based on a percentage of total sales revenue received by the Company multiplied by .00065. Mr. Frayser’s commission plan was terminated on May 1, 2023, and he received a partial commission of payment of $210,868 with respect to the 2023 fiscal year.

Long Term Equity Incentive Awards

The Company maintains the 2021 Omnibus Incentive Plan (the “Omnibus Plan”) to provide for the grant of stock options, stock appreciation rights, shares of restricted stock, restricted stock units, performance awards, cash-based awards and other equity-based awards to eligible directors, officers, and employees in order to attract, retain, and reward such individuals and strengthen the mutuality of interest between such individuals and the Company’s shareholders.

Equity Awards Granted to Named Executive Officers

The Company has used a variety of long-term equity incentive awards in our executive compensation program, including restricted stock units (“RSUs”), performance stock units (“PSUs”), and stock options (“Options”).

During the fiscal year ended December 30, 2023, the Compensation Committee granted RSUs and PSUs to our named executive officers, in order to appropriately retain and incentivize key executives who are important