The information in this proxy statement/prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 26, 2021

PRELIMINARY PROXY STATEMENT FOR

SPECIAL MEETING OF STOCKHOLDERS OF

JUNIPER INDUSTRIAL HOLDINGS, INC.

PROSPECTUS FOR 140,525,000 SHARES OF COMMON STOCK AND 27,400,000 WARRANTS OF

JANUS PARENT, INC.

The board of directors of Juniper Industrial Holdings, Inc., (“we,” “us,” “our,” “JIH” or the “Company”), has unanimously approved the Business Combination (as defined herein) contemplated by the Business Combination Agreement (as defined herein). As described in this proxy statement/prospectus, at the special meeting of stockholders (the “special meeting”), our stockholders will be asked to consider and vote upon a proposal, (the “Business Combination Proposal”), to approve the Business Combination and adopt the Business Combination Agreement. Our stockholders will also be asked to consider and vote upon the following proposals: (a) to approve and adopt the Parent Omnibus Incentive Plan (an equity-based incentive plan), a copy of which is attached to the accompanying proxy statement/prospectus as Annex B (the “Incentive Plan Proposal”); and (b) to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and voting of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes received to pass the resolution to approve the Business Combination Proposal, and the Incentive Plan Proposal, (the “Adjournment Proposal”). Each of these proposals is more fully described in the accompanying proxy statement/prospectus.

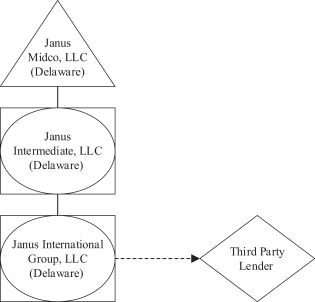

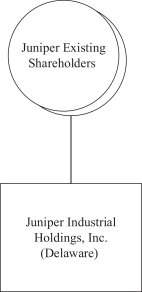

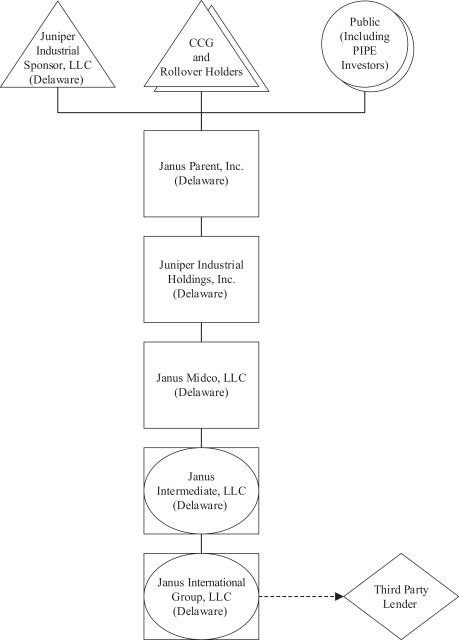

As a result of the consummation of the Transactions (as defined herein), Midco (as defined herein) will become a direct and indirect wholly owned subsidiary of Parent (as defined herein). Upon consummation of the Business Combination, Parent will become the public company and change its name to Janus International Group, Inc.

Pursuant to the Business Combination Agreement and by virtue of the JIH Merger (as defined herein), each outstanding share of our common stock will be converted into one share of Parent common stock and each of our outstanding warrants (other than the warrants held by our sponsor, Juniper Industrial Sponsor, LLC (the “Sponsor”)), entitling the holder thereof to purchase one share of Class A common stock at an exercise price of $11.50 per share, will be converted into the right to receive a warrant to purchase one share of Parent common stock at an exercise price of $11.50 per share upon consummation of the Business Combination. In addition, by virtue of the JIH Merger, the shares of our common stock and our warrants held by the Sponsor will be converted into the right to receive (i) an equivalent number of shares of Parent common stock, 2,000,000 of which shall be subject to the terms of an Earnout Agreement (pro rata among the Sponsor shares and shares owned by certain affiliates) and (ii) Parent warrants representing 50% of the number of Company warrants owned by Sponsor prior to the closing of the Transactions. A copy of the Business Combination Agreement is attached to this proxy statement/prospectus as Annex A. Accordingly, this prospectus covers an aggregate of 140,525,000 shares of Parent’s common stock and 27,400,000 Parent warrants.

Our Class A common stock, units and warrants are currently listed on the New York Stock Exchange (the “NYSE”) under the symbols “JIH,” “JIH.U” and “JIH WS,” respectively. Parent has applied to list, to be effective at the time of the Business Combination, its common stock and warrants on the NYSE under the symbols “JBI” and “JBI WS,” respectively. Upon the consummation of the Business Combination, all JIH units will be separated into their component securities, which will be exchanged for equivalent securities of Parent. We expect our Class A common stock, units and warrants will be delisted from the NYSE.

The accompanying proxy statement/prospectus provides shareholders of the Company with detailed information about the Business Combination and other matters to be considered at the special meeting. We encourage you to read the entire accompanying proxy statement/prospectus, including the annexes and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 28 of the accompanying proxy statement/prospectus.

This proxy statement/prospectus is dated , 2021, and is first being mailed to our stockholders on or about , 2021.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE TRANSACTIONS, PASSED UPON THE MERITS OR FAIRNESS OF THE TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.